placer county sales tax 2020

This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was.

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

The remaining 125 increment is for local.

. 636 Grider Dr Roseville CA. Placer County Sales Tax 2020. Roseville Ca Sales Tax Rate 2020.

The average cumulative sales tax rate between all of them is 731. Central Coast Placer Title Company Offices. This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price.

Roseville is located within placer county california. For tax rates in other cities see California sales taxes by city and county. The main increment is the state-imposed basic sales tax rate of 6.

As for zip codes there are around 29 of them. Any changes or corrections made after June 30th to prior year tax bills will not appear on the prior year screen. The minimum combined 2022 sales tax rate for Placer County California is.

Method to calculate Placer County sales tax in 2021. The current total local sales tax rate in placer county ca is 7250. This is the total of state and county sales tax rates.

The measure would create a 1 sales tax proceeds. California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes. This is the total of state and county sales tax rates.

Placer County CA Sales Tax Rate The current total local sales tax rate in Placer County CA is 7250. Appeal your property tax bill penalty fees. Cities Communities in Placer County.

The county sales tax rate is. Placer County California Sales Tax Rate 2022 Up to 775 The Placer County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Placer County in addition to. Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025.

You can print a 415 sales tax table here. You can find more. The December 2020 total local sales tax rate was also 7250.

California Vote Results 2020. Auburn Measure S was on the ballot as a referral in Auburn on November 3 2020. The average sales tax rate in California is 8551.

725 Is this data incorrect Download all California sales tax rates by zip. Estimate your supplemental tax with Placer County. Auburn Measure S.

A full list of. Please contact the Tax. The December 2020 total local sales tax rate was also 7250.

The next tax-defaulted land sale is tentatively scheduled for the fall of 2023. It was defeated. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

The California state sales tax rate is currently. The base sales tax rate of 725 consists of several components. All sales require full payment which includes the transfer tax and recording fee.

Placer County Sales Tax Rate 2020. Below you will find links to all departments within Placer County. 731 Average Sales Tax Summary Placer County is located in California and contains around 24 cities towns and other locations.

Placer County collects a 125 local sales tax the maximum local sales tax allowed under California law Placer County has a lower sales tax than 883 of Californias other cities and. Prior year screens reflect activity up to June 30th only. A yes vote supported authorizing an additional sales tax.

Find different option for paying your property taxes.

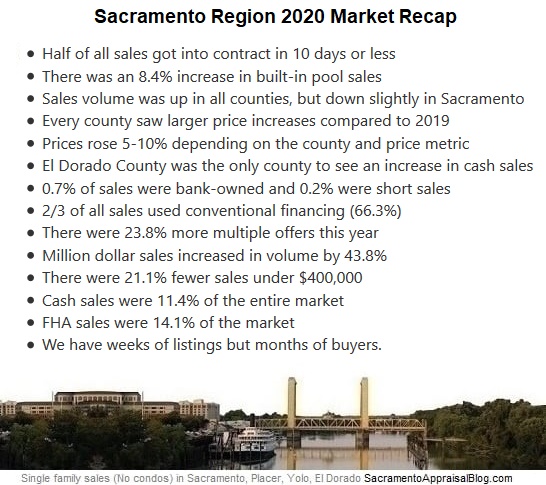

Six Things To Remember About Crazy Home Price Growth Sacramento Appraisal Blog Real Estate Appraiser

Sprta Model Regional Impact Fee Update Pctpa

Placer County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Placer County Billion Dollar Budget Approved On Unanimous Vote Roseville Today

News Flash Placer County Ca Civicengage

Placer County California Fha Va And Usda Loan Information

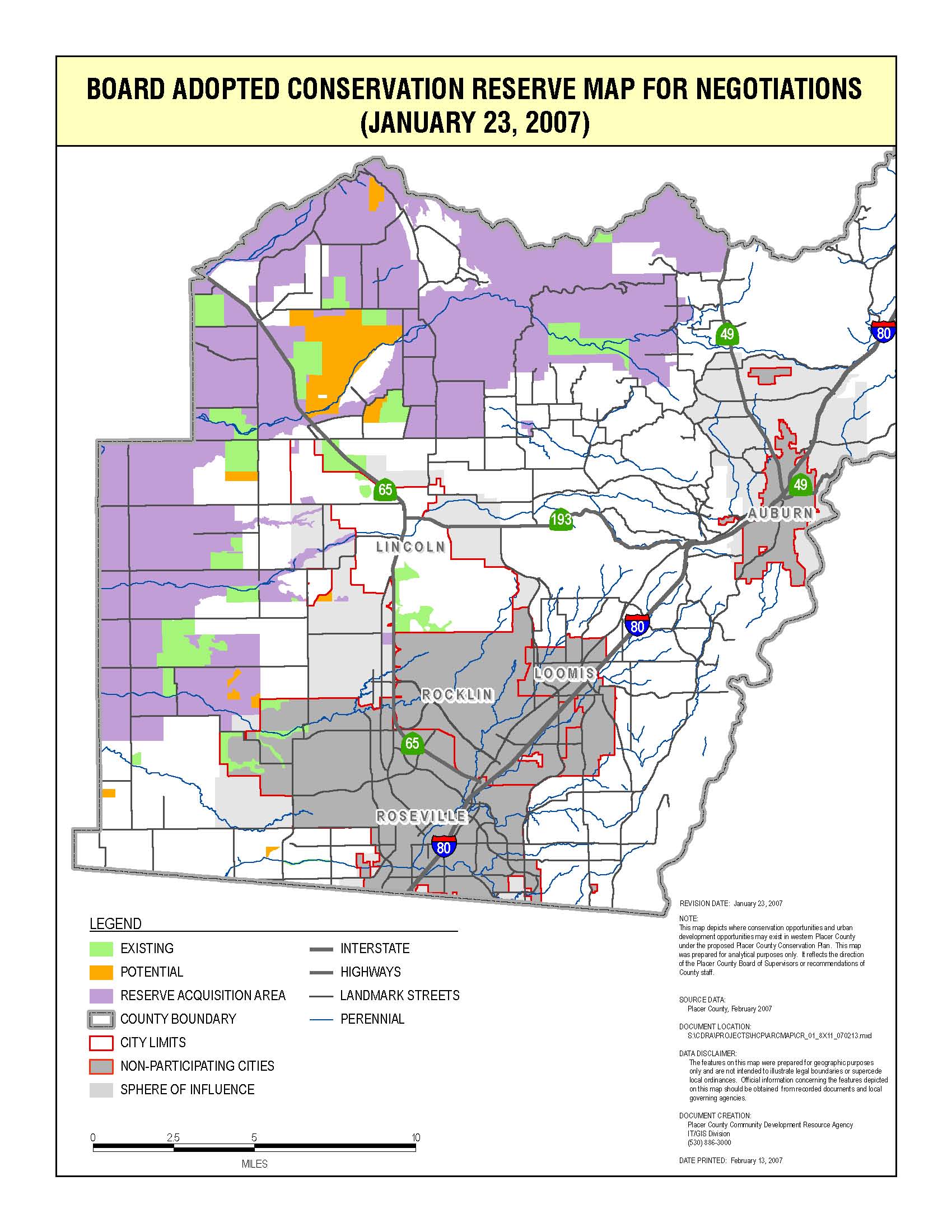

Placer County Conservation Plan Approved But Questions Linger Cp Dr

Covid Pushed Wealth Toward Eastern Part Of Sacramento Region Sacramento Business Journal

California Sales Tax Rates By City County 2022

The Arts Council Of Placer County Guidestar Profile

55 Threshold For Transportation Measures California Association Of Councils Of Governments

Placer County Transportation Planning Agency Pctpa California Association Of Councils Of Governments

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

News And Press Releases City Of Rocklin

The Housing Market Nobody Predicted